6 Ways To Make Coastal Carolina University Tuition Affordable Today

Introduction

Coastal Carolina University (CCU) offers a diverse range of academic programs and a vibrant campus life, making it an attractive choice for many students. However, the cost of tuition can be a significant concern for prospective students and their families. The good news is that there are several strategies and resources available to make CCU’s tuition more affordable and within reach. In this blog post, we will explore six effective ways to reduce the financial burden and help you achieve your educational goals at Coastal Carolina University.

1. Explore Financial Aid and Scholarships

One of the first steps towards making CCU tuition affordable is to thoroughly investigate the financial aid and scholarship opportunities offered by the university. CCU provides a comprehensive financial aid program, including grants, scholarships, work-study programs, and loans, to assist students in covering their educational expenses.

Grants and Scholarships:

- Federal Pell Grants: CCU participates in the Federal Pell Grant program, which provides need-based grants to undergraduate students. These grants do not need to be repaid and can significantly reduce the cost of tuition.

- CCU Scholarships: The university offers a variety of scholarships based on academic merit, talent, and financial need. Explore the CCU scholarship database to find opportunities that align with your strengths and interests.

- External Scholarships: In addition to CCU-specific scholarships, seek out external scholarships offered by private organizations, foundations, and community groups. These scholarships can provide valuable financial support and reduce your overall tuition expenses.

2. Apply for Federal Student Loans

Federal student loans are a popular option for financing your education. These loans offer flexible repayment plans and often have lower interest rates compared to private loans. By carefully considering your loan options and borrowing only what you need, you can manage your debt effectively.

Key Points:

- Direct Subsidized Loans: These loans are available to undergraduate students with demonstrated financial need. The U.S. Department of Education pays the interest on these loans while you are enrolled at least half-time and during certain periods of deferment.

- Direct Unsubsidized Loans: Undergraduate and graduate students are eligible for these loans, regardless of financial need. Interest accrues on these loans from the date of disbursement, but you have the option to pay the interest during school or defer it until after graduation.

- Direct PLUS Loans: Graduate or professional students, as well as parents of dependent undergraduate students, can apply for Direct PLUS Loans. These loans have a fixed interest rate and require a credit check.

3. Consider Work-Study Programs

CCU’s work-study program provides students with part-time employment opportunities on campus, allowing them to earn money to help cover their educational expenses. This program not only offers financial benefits but also valuable work experience and a chance to be part of the CCU community.

Benefits of Work-Study:

- Flexible Hours: Work-study jobs are designed to accommodate your academic schedule, offering flexibility in terms of work hours.

- On-Campus Employment: You can work in various departments and offices on campus, gaining valuable skills and networking opportunities.

- Financial Aid Contribution: The income earned through work-study can be applied directly towards your tuition and other educational expenses, reducing the overall cost.

4. Explore Tuition Payment Plans

CCU understands that paying tuition in full can be challenging for many students. To make it more manageable, the university offers tuition payment plans that allow you to spread out your tuition expenses over multiple installments.

How Tuition Payment Plans Work:

- Enrollment: You can enroll in a payment plan through the CCU website or by contacting the Office of Student Accounts.

- Down Payment: Typically, you will need to make an initial down payment at the time of enrollment.

- Monthly Installments: The remaining balance is divided into equal monthly payments, making it easier to budget and pay your tuition.

- No Interest: Payment plans at CCU do not usually charge interest, making them a cost-effective option.

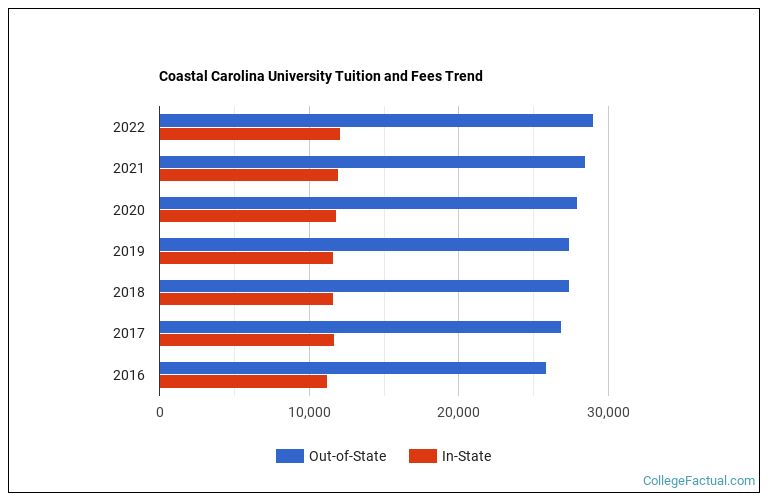

5. Take Advantage of In-State Tuition Rates

If you are a resident of South Carolina, you are eligible for in-state tuition rates at Coastal Carolina University, which can result in significant savings compared to out-of-state tuition. CCU offers a supportive environment and various resources to assist in-state students in making the most of their educational journey.

Benefits of In-State Tuition:

- Lower Tuition Costs: In-state students pay significantly less tuition than out-of-state students, making it more affordable to attend CCU.

- State-Specific Scholarships: Explore scholarship opportunities specifically designed for South Carolina residents. These scholarships can further reduce your financial burden.

- Familiar Surroundings: Attending a university in your home state often means being closer to family and friends, providing a sense of comfort and support.

6. Transfer Credits and Accelerate Your Degree

Transferring credits from previous colleges or universities, or earning credits through advanced placement exams, can help you reduce the overall time and cost of your degree. By accelerating your degree completion, you can save money on tuition and enter the job market sooner.

Strategies for Transferring Credits:

- Review CCU’s Transfer Credit Policy: Familiarize yourself with CCU’s guidelines for transferring credits. The university accepts credits from accredited institutions, so ensure your previous coursework meets their requirements.

- Official Transcripts: Request official transcripts from all previously attended institutions and submit them to CCU for evaluation.

- Advanced Placement (AP) Credits: If you have taken AP exams, check if CCU accepts AP credits. These credits can be applied towards your degree, reducing the number of courses you need to take.

Conclusion

Making Coastal Carolina University’s tuition affordable is achievable through a combination of financial aid, scholarships, loans, work-study programs, payment plans, and strategic credit transfers. By exploring these options and tailoring them to your individual circumstances, you can pursue your academic goals at CCU without financial constraints. Remember, the university’s financial aid office and academic advisors are valuable resources to guide you through the process and ensure you make the most informed decisions for your educational journey.

FAQ

What is the deadline for applying for financial aid at CCU?

+

The priority deadline for submitting the Free Application for Federal Student Aid (FAFSA) is typically March 1st. However, it is recommended to apply as early as possible to maximize your chances of receiving financial aid.

Are there any scholarships specifically for international students at CCU?

+

Yes, CCU offers a limited number of scholarships for international students. These scholarships are highly competitive, so it is advisable to research and apply early to increase your chances of receiving one.

Can I work off-campus while enrolled in the work-study program?

+

Work-study jobs are designed to be on-campus positions. However, CCU may offer limited opportunities for off-campus work through community service placements. It is best to consult with the work-study office for more information.

Are there any additional fees besides tuition at CCU?

+

Yes, CCU charges various fees, including technology fees, student activity fees, and health services fees. These fees are typically included in the overall cost of attendance and are subject to change each academic year.

Can I appeal a financial aid decision if I feel it does not accurately reflect my financial need?

+

Yes, CCU allows students to appeal financial aid decisions. If you believe there are extenuating circumstances or changes in your financial situation that were not considered, you can submit an appeal to the financial aid office. They will review your case and make a determination based on the provided information.