Chase Wire Transfer: The Complete Guide To Sending And Receiving Money

Understanding Chase Wire Transfer

Chase Wire Transfer is a convenient and efficient way to send and receive money, offering a secure and fast method for financial transactions. This service allows individuals and businesses to transfer funds electronically, making it an essential tool for modern-day financial management. In this comprehensive guide, we will explore the ins and outs of Chase Wire Transfer, covering everything from its benefits to the step-by-step process of using this service. Whether you’re new to wire transfers or looking to enhance your understanding, this guide will provide you with valuable insights and practical tips.

Benefits of Chase Wire Transfer

Chase Wire Transfer offers a range of advantages that make it a preferred choice for many individuals and businesses. Here are some key benefits:

Speed and Efficiency: Wire transfers through Chase are processed quickly, ensuring that funds reach their destination within a short timeframe. This is especially beneficial for urgent financial needs or time-sensitive transactions.

Secure Transactions: Chase employs advanced security measures to protect your financial information and ensure the safety of your transactions. With robust encryption and fraud detection systems, you can have peace of mind when sending or receiving money.

Global Reach: Chase Wire Transfer allows you to send and receive funds internationally, making it ideal for businesses with global operations or individuals with international connections. The service supports multiple currencies, making it convenient for cross-border transactions.

Convenience: The wire transfer process is designed to be user-friendly and accessible. You can initiate transfers online or through the Chase Mobile app, providing flexibility and convenience for managing your finances on the go.

Competitive Exchange Rates: Chase offers competitive exchange rates for international wire transfers, helping you save on transaction costs. This is particularly advantageous for businesses that frequently engage in cross-border trade or individuals who regularly send money abroad.

How to Send a Wire Transfer with Chase

Sending a wire transfer with Chase is a straightforward process. Follow these steps to initiate a wire transfer:

Log in to Your Chase Account: Access your Chase account online or through the mobile app. Ensure you have the necessary credentials to log in securely.

Navigate to the Wire Transfer Option: Look for the “Wire Transfer” or “Transfer Money” option in the menu. This section will guide you through the process of initiating a wire transfer.

Select the Type of Transfer: Choose whether you want to send a domestic or international wire transfer. The options and requirements may vary based on the type of transfer you select.

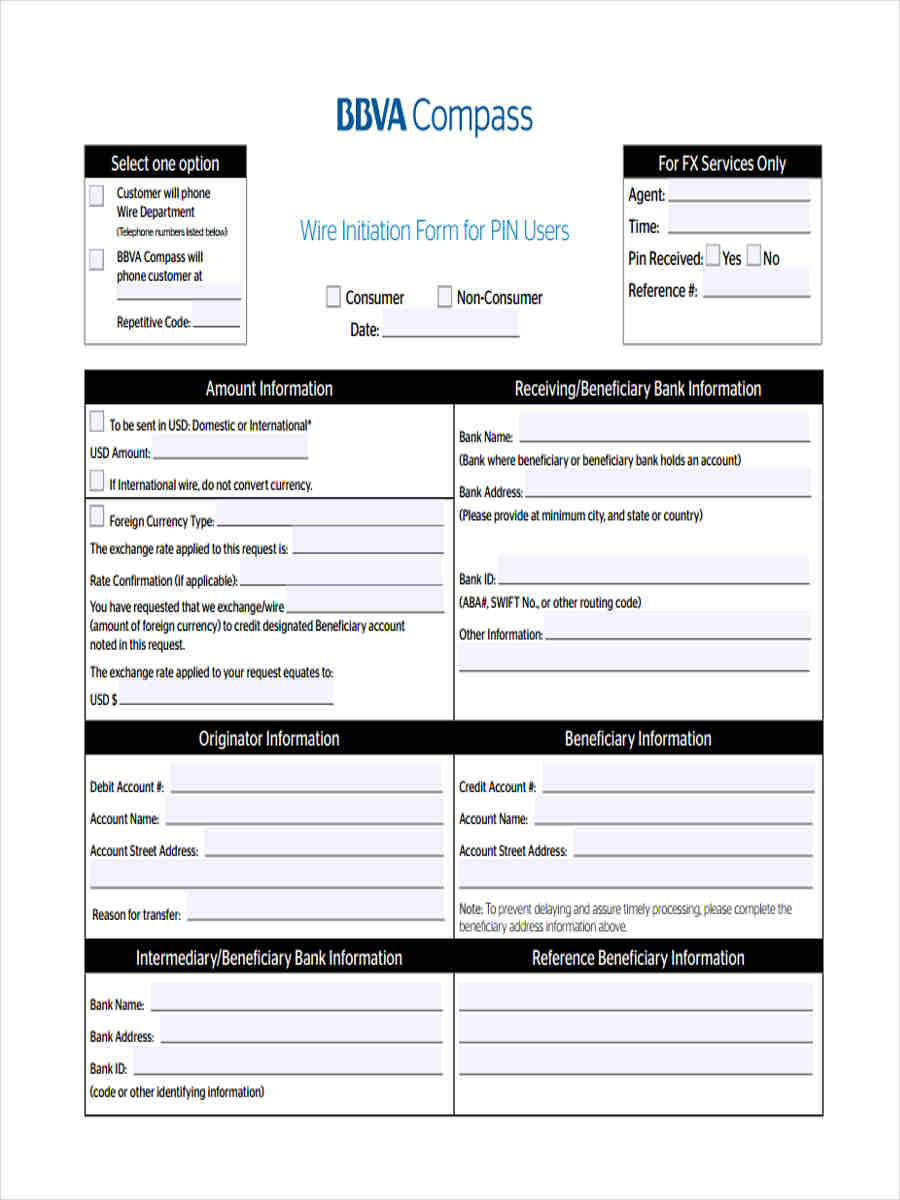

Enter Recipient Details: Provide the necessary information about the recipient, including their name, account number, and banking details. Ensure accuracy to avoid delays or errors.

Specify Transfer Amount and Currency: Enter the amount you wish to transfer and select the appropriate currency. Double-check the details to avoid any mistakes.

Review and Confirm: Carefully review the transfer details, including the recipient’s information, amount, and currency. Once you are satisfied, confirm the transfer.

Complete the Transfer: Follow the prompts to complete the wire transfer process. This may involve providing additional security information or verifying your identity.

Keep a Record: After completing the transfer, save the transaction details for future reference. This will help you track the progress of the transfer and resolve any potential issues.

How to Receive a Wire Transfer with Chase

Receiving a wire transfer with Chase is a simple process. Here’s what you need to do:

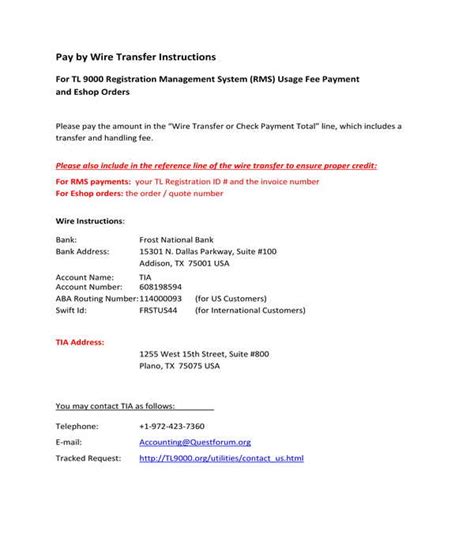

Provide Wire Transfer Instructions: Share your Chase account details, including your name, account number, and the bank’s information, with the sender. Ensure that they have the correct details to initiate the transfer.

Wait for the Transfer: Once the sender initiates the wire transfer, it will be processed and sent to your Chase account. The time it takes for the transfer to reach your account may vary depending on the origin and destination of the funds.

Check Your Account: Regularly monitor your Chase account to see if the wire transfer has been received. You can log in to your online account or use the mobile app to check for incoming funds.

Verify the Transfer: When the wire transfer arrives, verify the amount and currency to ensure it matches the expected transfer. If there are any discrepancies, contact the sender immediately to resolve the issue.

Wire Transfer Fees and Limits

Understanding the fees and limits associated with Chase Wire Transfer is essential for effective financial planning. Here’s an overview:

Fees: Chase may charge fees for wire transfers, depending on the type of transfer and the account you hold. These fees can vary for domestic and international transfers. It’s recommended to check the current fee schedule on the Chase website or consult with a Chase representative for accurate information.

Transfer Limits: Chase sets limits on the amount of money that can be sent or received through wire transfers. These limits are in place to ensure the security and compliance of transactions. The specific limits may vary based on your account type and transaction history.

Currency Restrictions: Chase Wire Transfer supports multiple currencies, but there may be restrictions on certain currencies or countries. It’s important to check the currency options and any applicable restrictions before initiating a transfer.

Troubleshooting Common Wire Transfer Issues

While wire transfers are generally secure and efficient, occasional issues may arise. Here are some common problems and their potential solutions:

Delayed Transfers: If a wire transfer takes longer than expected to reach your account, it could be due to various reasons, such as bank processing times or international regulations. Contact Chase customer support to inquire about the status of the transfer and explore potential solutions.

Incorrect Recipient Details: Providing incorrect recipient details can lead to failed or delayed wire transfers. Double-check the information before initiating the transfer and contact the sender if any corrections are needed.

Insufficient Funds: Wire transfers require sufficient funds in your account to cover the transfer amount and any applicable fees. Ensure that you have enough funds available before initiating the transfer to avoid any disruptions.

Security Concerns: If you have concerns about the security of a wire transfer, contact Chase customer support immediately. They can provide guidance and assistance to address any potential risks or fraudulent activities.

Additional Tips for Wire Transfer Success

To ensure a smooth and successful wire transfer experience, consider the following tips:

Plan Ahead: Wire transfers can be time-sensitive, so plan your transactions in advance. Allow sufficient time for the transfer to be processed and reach its destination, especially for international transfers.

Keep Records: Maintain a record of all wire transfer transactions, including dates, amounts, and recipient details. This will help you track your financial activities and resolve any disputes or queries efficiently.

Use Secure Channels: When sharing sensitive information, such as account details or transfer instructions, use secure communication channels. Avoid sharing confidential information over public Wi-Fi or unsecured networks.

Regularly Update Your Information: Keep your contact and account details up to date with Chase. This ensures that you receive important notifications and updates regarding your wire transfers.

Seek Assistance: If you encounter any challenges or have questions about wire transfers, don’t hesitate to reach out to Chase customer support. They can provide guidance and support to ensure a positive wire transfer experience.

Conclusion

Chase Wire Transfer offers a reliable and efficient way to send and receive money, both domestically and internationally. By understanding the benefits, following the step-by-step process, and being aware of potential fees and limits, you can make the most of this service. Remember to plan ahead, maintain records, and prioritize security to ensure a smooth and successful wire transfer experience. With Chase Wire Transfer, managing your finances becomes more accessible and convenient, empowering you to stay on top of your financial goals.

FAQ

Can I cancel a wire transfer after it has been initiated?

+In certain cases, it may be possible to cancel a wire transfer, but it depends on the progress of the transfer. Contact Chase customer support as soon as possible to inquire about the cancellation process and the likelihood of success.

How long does it take for a wire transfer to be processed?

+The processing time for wire transfers can vary depending on factors such as the origin and destination of the funds, as well as any applicable regulations. Domestic wire transfers typically take 1-2 business days, while international transfers may take longer, often 3-5 business days.

Are there any limitations on the amount I can transfer?

+Yes, Chase sets limits on the amount that can be transferred through wire transfers. These limits may vary based on your account type and transaction history. It’s important to check the specific limits and ensure you have sufficient funds to cover the transfer amount and any applicable fees.

Can I track the progress of my wire transfer?

+Yes, you can track the progress of your wire transfer by logging into your Chase account online or using the mobile app. The transaction details will provide updates on the status of the transfer, allowing you to monitor its progress and receive notifications when it is completed.

What security measures does Chase have in place for wire transfers?

+Chase employs robust security measures to protect your wire transfers. This includes advanced encryption technologies, fraud detection systems, and secure communication channels. Additionally, Chase may require additional security verification during the transfer process to ensure the safety of your funds.