Design The Ultimate Government Spending Multiplier Equation Now

Introduction to the Government Spending Multiplier

The government spending multiplier, a concept rooted in Keynesian economics, is a powerful tool for understanding the impact of government expenditure on a nation’s economy. It quantifies the relationship between changes in government spending and the subsequent effect on aggregate output or income. By estimating the multiplier, policymakers can make informed decisions regarding fiscal policy, stimulating economic growth, and managing economic downturns. In this blog, we will delve into the intricacies of constructing the ultimate government spending multiplier equation, exploring its key components and the insights it provides.

Understanding the Basics

Before diving into the equation, let’s grasp some fundamental concepts:

- Aggregate Output or Income (Y): This represents the total output or income generated within an economy. It is the sum of consumption ©, investment (I), government spending (G), and net exports (X - M).

- Consumption ©: Refers to the spending by households on goods and services. It is influenced by factors such as disposable income, wealth, and consumer confidence.

- Investment (I): Encompasses spending by businesses on capital goods, inventory, and structures. It is driven by expectations of future profits and the cost of capital.

- Government Spending (G): Comprises expenditures by the government on public goods, infrastructure, social services, and other government programs.

- Net Exports (X - M): Reflects the difference between exports (X) and imports (M). A positive value indicates a trade surplus, while a negative value signifies a trade deficit.

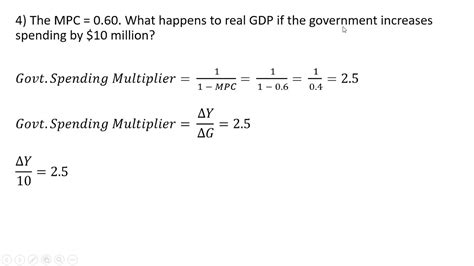

The Government Spending Multiplier Equation

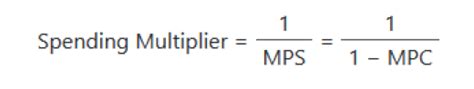

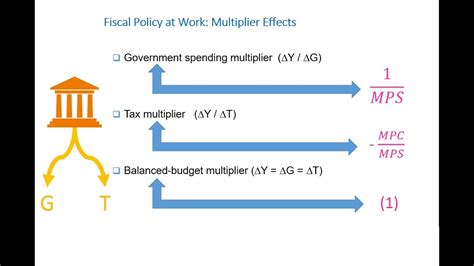

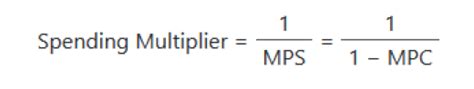

The government spending multiplier equation is a mathematical representation of the relationship between changes in government spending and the resulting impact on aggregate output or income. It is typically expressed as:

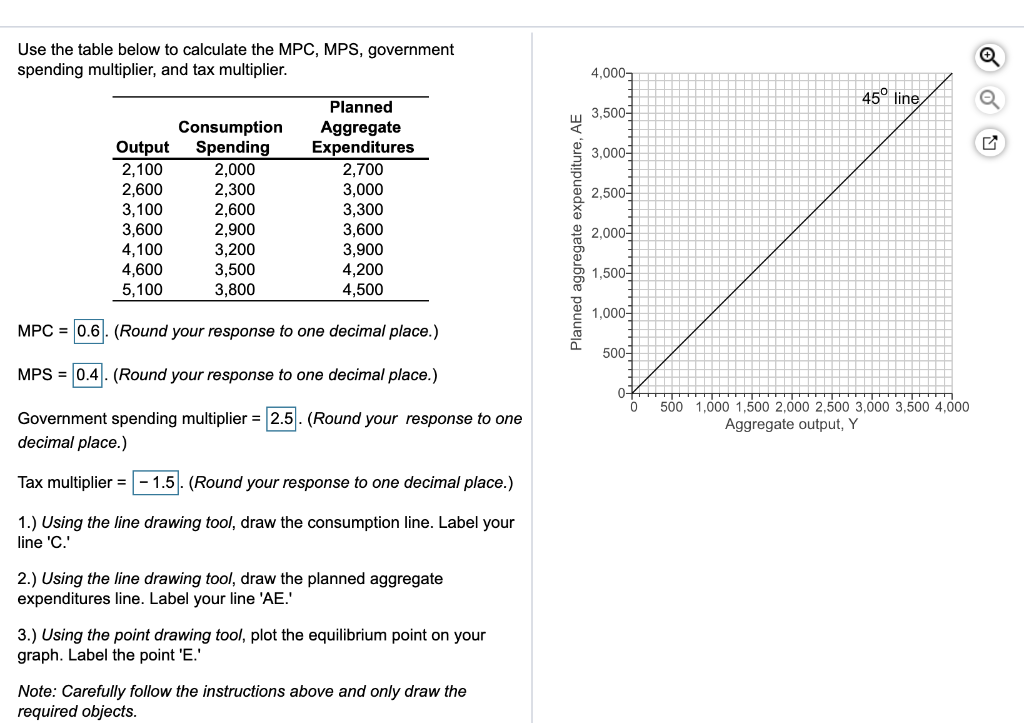

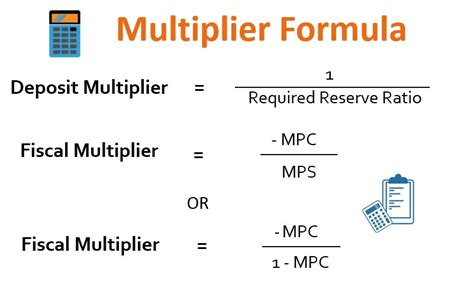

\[ \begin{equation*} \text{Multiplier} = \frac{1}{1 - \text{MPC}} \end{equation*} \]

Where: - Multiplier is the government spending multiplier. - MPC is the marginal propensity to consume, which represents the proportion of additional income that households spend on consumption.

Deriving the Multiplier

To understand the derivation of the multiplier, let’s consider a simple economy with the following relationship:

\[ \begin{equation*} Y = C + I + G + (X - M) \end{equation*} \]

Where: - Y is the aggregate output or income. - C is consumption. - I is investment. - G is government spending. - (X - M) is net exports.

Now, let’s assume that government spending increases by a certain amount, denoted as \Delta G. This change in government spending will lead to a corresponding change in aggregate output or income, \Delta Y. The relationship between these changes can be expressed as:

\[ \begin{equation*} \Delta Y = \Delta C + \Delta I + \Delta G + \Delta (X - M) \end{equation*} \]

In a closed economy with no net exports, (X - M) = 0, the equation simplifies to:

\[ \begin{equation*} \Delta Y = \Delta C + \Delta I + \Delta G \end{equation*} \]

Next, we need to consider the relationship between consumption and income. The marginal propensity to consume (MPC) represents the fraction of additional income that is spent on consumption. It can be expressed as:

\[ \begin{equation*} \text{MPC} = \frac{\Delta C}{\Delta Y} \end{equation*} \]

Substituting this expression into the equation for \Delta Y, we get:

\[ \begin{align*} \Delta Y & = \text{MPC} \cdot \Delta Y + \Delta I + \Delta G \\ \Delta Y \cdot (1 - \text{MPC}) & = \Delta I + \Delta G \end{align*} \]

Solving for \Delta Y, we find:

\[ \begin{equation*} \Delta Y = \frac{1}{1 - \text{MPC}} \cdot (\Delta I + \Delta G) \end{equation*} \]

This equation represents the government spending multiplier. It shows that the change in aggregate output or income (\Delta Y) is equal to the reciprocal of (1 - \text{MPC}) multiplied by the sum of the changes in investment (\Delta I) and government spending (\Delta G).

Interpreting the Multiplier

The government spending multiplier provides valuable insights into the impact of government expenditure on the economy:

- Positive Multiplier: A positive multiplier indicates that an increase in government spending leads to a larger increase in aggregate output or income. This occurs because the initial increase in government spending stimulates consumption and investment, which further boosts economic activity.

- Size of the Multiplier: The size of the multiplier depends on the marginal propensity to consume (MPC). A higher MPC implies a larger multiplier, as a larger portion of the additional income is spent on consumption, leading to a stronger multiplier effect.

- Multiplier and Fiscal Policy: Policymakers can use the multiplier to assess the potential impact of changes in government spending. By estimating the multiplier, they can gauge the effectiveness of fiscal policy measures, such as stimulus packages or austerity measures, in influencing economic growth.

Factors Influencing the Multiplier

Several factors can influence the size and effectiveness of the government spending multiplier:

- Marginal Propensity to Consume (MPC): As mentioned earlier, the MPC plays a crucial role in determining the multiplier. A higher MPC implies a larger multiplier, as households are more likely to spend a larger portion of their additional income.

- Investment Sensitivity: The sensitivity of investment to changes in income or government spending can impact the multiplier. If investment is highly responsive to changes in income, the multiplier effect may be amplified.

- Crowding Out Effect: The crowding out effect occurs when increased government spending leads to a reduction in private investment. This can happen when government borrowing to finance spending raises interest rates, making private investment less attractive. The crowding out effect can reduce the effectiveness of the multiplier.

- Time Lag: There is often a time lag between changes in government spending and their impact on aggregate output or income. This lag can influence the timing and magnitude of the multiplier effect.

Applying the Multiplier in Policy

The government spending multiplier is a valuable tool for policymakers when designing and implementing fiscal policy:

- Stimulus Packages: During economic downturns, governments may implement stimulus packages to boost economic activity. By estimating the multiplier, policymakers can assess the potential impact of increased government spending on aggregate output or income, guiding the design and scale of the stimulus.

- Austerity Measures: In times of fiscal restraint, governments may consider austerity measures to reduce spending. The multiplier can help evaluate the potential economic consequences of spending cuts, allowing policymakers to strike a balance between fiscal consolidation and economic growth.

- Infrastructure Investment: Governments often invest in infrastructure projects to stimulate economic growth and create jobs. The multiplier can be used to assess the potential impact of these investments on aggregate output or income, ensuring efficient allocation of resources.

Limitations and Considerations

While the government spending multiplier is a powerful concept, it is important to consider its limitations:

- Simplified Model: The multiplier equation is a simplified representation of a complex economic system. It assumes a closed economy with no net exports and neglects other factors that can influence economic activity, such as taxes, imports, and government revenues.

- Static Analysis: The multiplier equation provides a static analysis of the relationship between government spending and aggregate output or income. It does not account for dynamic effects, such as changes in expectations, technology, or market conditions, which can influence the multiplier over time.

- Assumptions and Parameters: The accuracy of the multiplier equation depends on the assumptions and parameters used. The values of MPC, investment sensitivity, and other factors may vary across different economies and time periods, affecting the precision of the multiplier estimate.

Real-World Applications

The government spending multiplier has been applied in various real-world scenarios to guide fiscal policy decisions:

- Great Recession: During the Great Recession of 2008-2009, many governments implemented stimulus packages to combat the economic downturn. The multiplier was used to estimate the potential impact of these packages on aggregate output or income, informing policy choices.

- Post-War Reconstruction: In the aftermath of World War II, governments invested heavily in infrastructure and social programs to stimulate economic recovery. The multiplier played a role in assessing the potential economic benefits of these investments.

- Austerity Measures: Some countries, such as Greece and Portugal, have implemented austerity measures to address fiscal challenges. The multiplier has been used to evaluate the potential economic consequences of spending cuts and to guide policy decisions.

Interactive Tools and Visualizations

To enhance understanding and engagement, interactive tools and visualizations can be employed:

- Multiplier Calculator: Develop an online calculator that allows users to input values for MPC, investment sensitivity, and government spending changes to estimate the multiplier. This tool can provide a hands-on experience for users to explore the relationship between these variables.

- Multiplier Simulation: Create an interactive simulation that illustrates the multiplier effect. Users can adjust government spending levels and observe the resulting changes in aggregate output or income, providing a visual representation of the multiplier concept.

- Policy Scenario Analysis: Develop a tool that allows users to input different fiscal policy scenarios, such as stimulus packages or austerity measures, and visualize the potential impact on aggregate output or income using the multiplier equation.

Conclusion

The government spending multiplier is a fundamental concept in Keynesian economics, offering valuable insights into the relationship between government expenditure and economic activity. By understanding the derivation and interpretation of the multiplier, policymakers can make informed decisions regarding fiscal policy, aiming to stimulate economic growth and manage economic downturns effectively. While the multiplier equation provides a powerful tool, it is essential to consider its limitations and assumptions when applying it to real-world policy decisions. By combining theoretical understanding with empirical analysis, policymakers can harness the power of the government spending multiplier to shape a more prosperous and stable economy.

FAQ

What is the significance of the government spending multiplier in economic policy?

+The government spending multiplier plays a crucial role in economic policy by providing insights into the impact of government expenditure on aggregate output or income. It helps policymakers assess the effectiveness of fiscal policy measures, such as stimulus packages or austerity measures, guiding their decisions to stimulate economic growth or manage economic downturns.

How does the marginal propensity to consume (MPC) influence the multiplier?

+The MPC represents the proportion of additional income that households spend on consumption. A higher MPC implies a larger multiplier, as a larger portion of the additional income is spent on consumption, leading to a stronger multiplier effect. This relationship highlights the importance of understanding consumer behavior when estimating the multiplier.

What is the crowding out effect, and how does it impact the multiplier?

+The crowding out effect occurs when increased government spending leads to a reduction in private investment. This can happen when government borrowing to finance spending raises interest rates, making private investment less attractive. The crowding out effect can reduce the effectiveness of the multiplier by offsetting the positive impact of increased government spending.

How can policymakers use the multiplier in real-world policy decisions?

+Policymakers can use the multiplier to estimate the potential impact of changes in government spending on aggregate output or income. This information can guide policy choices, such as the design and scale of stimulus packages during economic downturns or the evaluation of austerity measures in times of fiscal restraint. By considering the multiplier, policymakers can make informed decisions to achieve their economic objectives.

What are the limitations of the government spending multiplier equation?

+The government spending multiplier equation is a simplified representation of a complex economic system. It assumes a closed economy with no net exports and neglects other factors that can influence economic activity. Additionally, the equation provides a static analysis, neglecting dynamic effects such as changes in expectations and market conditions. The accuracy of the multiplier also depends on the assumptions and parameters used, which may vary across different economies and time periods.