Paycheck Calculator New Mexico

Calculating your paycheck accurately is crucial for financial planning and understanding your earnings. In New Mexico, the process involves considering various factors such as your salary, deductions, and tax withholdings. This comprehensive guide will walk you through the steps to calculate your paycheck in New Mexico, ensuring you have a clear understanding of your take-home pay.

Understanding Your Earnings

Before diving into the calculations, it's essential to have a solid grasp of your earnings. Whether you're an employee or a freelancer, your income can come from various sources, including:

- Salary or Wages: This is the regular income you receive from your employer, typically paid on a bi-weekly or monthly basis.

- Bonuses and Commissions: Additional payments based on performance or sales achievements.

- Freelance Work: Income generated from independent contracting or self-employment.

- Gigs and Side Hustles: Earnings from part-time jobs or freelance projects.

Understanding your income sources is the first step toward accurate paycheck calculations.

Calculating Gross Income

Your gross income is the total amount earned before any deductions or taxes are applied. To calculate your gross income, follow these steps:

- Determine your hourly rate or salary. For salaried employees, this is straightforward. For hourly workers, multiply your hourly rate by the number of hours worked.

- If you have multiple income sources, add up the earnings from each source to get your total gross income.

Example:

| Income Source | Earnings |

|---|---|

| Salary | $40,000 |

| Freelance Work | $5,000 |

| Total Gross Income | $45,000 |

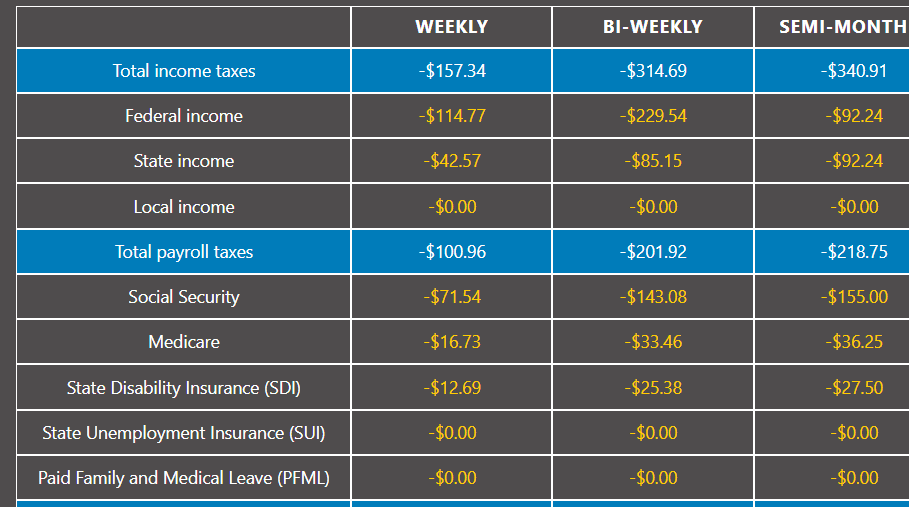

Understanding Deductions

Deductions are amounts subtracted from your gross income to arrive at your net pay. Common deductions in New Mexico include:

- Federal Income Tax: Based on your earnings and filing status, federal income tax is withheld from your paycheck.

- State Income Tax: New Mexico has a state income tax, and the rate may vary depending on your income level.

- Social Security and Medicare Taxes: These are mandatory deductions for most employees.

- Optional Deductions: These may include contributions to retirement plans, health insurance premiums, or other benefits.

Calculating Net Pay

Your net pay, or take-home pay, is the amount you receive after all deductions are applied. To calculate your net pay:

- Subtract mandatory deductions (federal and state income tax, Social Security, and Medicare) from your gross income.

- Subtract any optional deductions, such as retirement plan contributions or insurance premiums.

- The remaining amount is your net pay.

Example:

| Deduction | Amount |

|---|---|

| Federal Income Tax | $3,000 |

| State Income Tax | $1,200 |

| Social Security | $1,500 |

| Medicare | $500 |

| Retirement Plan | $1,000 |

| Net Pay | $38,800 |

Factors Affecting Paycheck Calculations

Several factors can impact your paycheck calculations in New Mexico. These include:

- Tax Brackets: New Mexico has different tax brackets based on income levels. Understanding your tax bracket is crucial for accurate tax withholding.

- Filing Status: Your filing status (single, married filing jointly, etc.) affects your tax rate and deductions.

- Allowances and Exemptions: You can claim allowances or exemptions to reduce your taxable income, which may impact your paycheck calculations.

- Payroll Frequency: The frequency of your paychecks (weekly, bi-weekly, monthly) can affect the timing and amount of deductions.

Payroll Calculators and Tools

To simplify the paycheck calculation process, you can utilize online payroll calculators and tools. These tools can help you estimate your deductions and net pay based on your income and personal circumstances. Some popular options include:

Remember to input accurate information to ensure the most precise results.

Tips for Maximizing Your Take-Home Pay

While you can't control all factors affecting your paycheck, there are strategies to maximize your take-home pay:

- Review Deductions: Periodically review your payroll deductions to ensure they are accurate and up-to-date.

- Adjust Withholdings: If you receive a large tax refund, consider adjusting your tax withholdings to increase your take-home pay throughout the year.

- Explore Tax Credits and Deductions: Research tax credits and deductions you may be eligible for to reduce your taxable income.

- Optimize Retirement Contributions: Contribute enough to your retirement plan to receive any matching contributions from your employer, but be mindful of the impact on your take-home pay.

Paycheck Calculator: Wrapping Up

Calculating your paycheck in New Mexico involves understanding your earnings, deductions, and tax obligations. By following the steps outlined in this guide and utilizing available resources, you can gain a clear understanding of your take-home pay. Remember to stay informed about tax laws and regulations in New Mexico to ensure accurate and timely paycheck calculations.

How often should I review my paycheck calculations?

+It’s a good practice to review your paycheck calculations annually, especially when tax laws or your personal circumstances change. Regular reviews help ensure accuracy and allow you to make any necessary adjustments.

Can I adjust my tax withholdings to increase my take-home pay?

+Yes, you can adjust your tax withholdings by completing a new W-4 form with your employer. This can help increase your take-home pay by reducing the amount of tax withheld from your paycheck.

What if I have additional questions about paycheck calculations in New Mexico?

+If you have specific questions or concerns, it’s best to consult a tax professional or reach out to the New Mexico Taxation and Revenue Department for guidance.