Tricare Reserve Select Cost Family

Understanding Tricare Reserve Select Costs for Families

Tricare Reserve Select is a premium-based health plan that offers comprehensive medical coverage to qualified Reserve Component members and their families. When considering this plan, it’s essential to understand the associated costs to ensure you’re making an informed decision for your family’s healthcare needs. The cost of Tricare Reserve Select for families can vary based on several factors, including the sponsor’s status, family size, and the number of dependents.

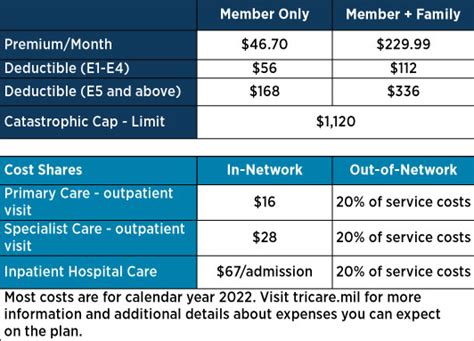

The premium costs for Tricare Reserve Select are typically lower compared to other plans, but it's crucial to factor in additional expenses such as copayments, coinsurance, and deductibles. These out-of-pocket costs can add up quickly, so it's vital to review the plan's details and estimate your total expenses before enrollment.

Calculating Tricare Reserve Select Costs

To calculate the costs of Tricare Reserve Select for your family, consider the following factors: * Premiums: The monthly premium for Tricare Reserve Select varies based on the sponsor’s status and family size. For example, the premium for a single sponsor is typically lower than for a family. * Copayments: These are fixed amounts you pay for specific services, such as doctor visits or prescriptions. * Coinsurance: This is a percentage of the total cost for certain services, such as hospital stays or surgeries. * Deductibles: These are the amounts you must pay out-of-pocket before Tricare starts covering expenses.

Here's a breakdown of the estimated costs for Tricare Reserve Select:

| Category | Cost |

|---|---|

| Monthly Premium (Single) | $45.62 - $65.14 |

| Monthly Premium (Family) | $223.01 - $458.19 |

| Copayment (Primary Care) | $15 - $30 |

| Copayment (Specialty Care) | $30 - $50 |

| Coinsurance (Inpatient Care) | 10% - 20% |

| Deductible (Individual) | $50 - $150 |

| Deductible (Family) | $100 - $300 |

Factors Affecting Tricare Reserve Select Costs

Several factors can influence the costs of Tricare Reserve Select for families, including: * Sponsor's status: The sponsor's military status, such as Reserve or National Guard, can impact premium costs. * Family size: Larger families typically require higher premiums. * Number of dependents: The number of dependents, such as spouses or children, can affect premium costs. * Location: Healthcare costs can vary depending on your location, with urban areas tend to be more expensive than rural areas.

📝 Note: It's essential to review the Tricare Reserve Select plan details and estimate your total expenses before enrollment to ensure you're making an informed decision for your family's healthcare needs.

Maximizing Tricare Reserve Select Benefits

To get the most out of your Tricare Reserve Select plan, consider the following tips: * Use in-network providers: Visiting in-network providers can help reduce out-of-pocket costs. * Take advantage of preventive care: Tricare Reserve Select covers various preventive care services, such as vaccinations and health screenings. * Manage chronic conditions: Effectively managing chronic conditions can help reduce healthcare expenses in the long run. * Review and adjust your plan: Regularly review your plan and adjust as needed to ensure you’re getting the best coverage for your family’s needs.

In summary, Tricare Reserve Select offers comprehensive medical coverage to qualified Reserve Component members and their families, but it’s crucial to understand the associated costs and factors that can impact them. By carefully reviewing the plan details and estimating your total expenses, you can make an informed decision for your family’s healthcare needs and maximize the benefits of your Tricare Reserve Select plan.

What is Tricare Reserve Select?

+Tricare Reserve Select is a premium-based health plan that offers comprehensive medical coverage to qualified Reserve Component members and their families.

How much does Tricare Reserve Select cost for families?

+The cost of Tricare Reserve Select for families varies based on several factors, including the sponsor’s status, family size, and the number of dependents. The monthly premium for a family can range from 223.01 to 458.19.

What factors affect Tricare Reserve Select costs?

+Several factors can influence the costs of Tricare Reserve Select, including the sponsor’s status, family size, number of dependents, and location.